5 Top Performers of ABSL Mutual Fund That Needs to be in Your Portfolio

Aditya Birla Sun Life Mutual Fund is known for providing some of the best mutual funds in the Indian market. The investor-centric approach has allowed it to win the trust of millions of investors over the years. Following are the top schemes which have been selected by the experts at MySIPonline after analysing every aspect of mutual funds.

Aditya Birla Sun Life Tax Relief 96 Fund

This should be your ultimate choice for tax deduction if you can take a slightly higher risk for long term investment. It is a prominent ELSS scheme which has a golden past of providing phenomenal returns to the investors. The fund allows tax deduction of up to Rs 46,800 every financial year and delivers high returns on the invested amount through an aggressive equity portfolio. Potential investors must note that the fund possesses high risk and must be chosen for the long term.

Aditya Birla Sun Life Equity Fund

It is a multi-cap scheme which is largely chosen and appreciated by the investors due to its consistency. The fund manager invests in the most adequate type of equity instruments from the range of top 500 stocks on the stock exchange. The opportunity for growth can be grabbed from any segment of the equity market. It has an impressive past and can be an ideal choice for the investors who seek a diversified portfolio for consistent capital gains.

Aditya Birla Sun Life Frontline Equity Fund

It is a largely chosen large-cap scheme which invests in equity instruments of prominent companies in India. The fund is known for providing consistent gains in the long term and has been trusted by a large number of investors. The AUM is more than Rs 21,500 crore. It is ideal for investors who seek a pure equity scheme with low risk for a tenure of 3 years or more.

Aditya Birla Sun Life Regular Savings Fund

This is a conservative hybrid scheme which is also known as a debt-oriented hybrid scheme. The fund invests nearly 70% of the corpus in the fixed income securities and the rest in equity instruments to deliver reasonable gains at low risk. It is ideal for those who are not satisfied with the returns of pure debt scheme but cannot invest in an equity-oriented scheme.

Aditya Birla Sun Life Banking & Financial Services Fund

It is a sectoral fund which predominantly uses the equity instruments of financial companies. As the sector has always done well in the Indian market and the government is focused to add more strength to the sector, this scheme can deliver impressive gains to the investors. It is ideal for the experienced investors who can make better decisions regarding investments as the risk is high but the rewards are higher.

Aditya Birla Sun Life Mutual Fund is a top player in the mutual fund industry and has provided some of the best performing mutual funds in India. There is a large number of top-performing schemes available to invest. Investors should choose the most suitable scheme from a wide variety of available mutual funds which can help oneself to achieve the financial objective. To know more about the schemes or to check the suitability, connect with the financial experts at MySIPonline.

Are Liquid Fund Investors Shifting Towards Overnight Funds?

In the last week of June 2019, Securities and Exchange Board of India (SEBI) decided to impose exit load on liquid mutual funds for redemption made within 7 days after investment. This has directly affected the liquid fund investors who used the schemes to park the corpus for a short term. As a result, the overnight funds are gaining popularity after the amendments in the mandate of liquid funds. The investors are also shifting away towards different means to park the temporary corpus. Why did SEBI take such a step that is forcing the investors to shift away? Let’s hear out what the experts at MySIPonline think about the recently introduced norms on liquid mutual funds.

Why are Investors Moving Away From Liquid Funds?

Some investors use liquid funds to park the surplus cash that can be withdrawn whenever there arises a need. Many of the institutional investors also use it to invest on Friday and redeem on Monday to use it for various purpose. A graded exit load on redemption within 7 days has decreased the interest of such investors in liquid funds. Overnight funds, on the other hand, invest in securities that mature within a day and no exit load is charged on redemption. Hence, the overnight funds are becoming the new destination for the investors who invest and withdraw often.

What are the New Norms on Liquid Funds?

Apart from invoking exit load for 7 days, the latest norms on liquid funds have lowered the proportion a fund can have in any particular sector. Only 20% of the corpus can be invested in a particular sector which was previously 25%. Liquid funds also have to compulsorily keep 20% of the corpus as cash or cash equivalent for handling sudden buying pressure.

What was the Need of the Norms?

The amendments were made to reduce the risk involved in liquid funds as many of the fixed income securities have defaulted recently. To avoid any damage to the investors, SEBI introduced 7-day exit load. Frequent purchase and redemption of a significant amount in liquid funds increase the volatility of liquid funds and it gets tougher for the fund managers to handle such frequent buying pressure. The other norms were also introduced to reduce the volatility as lower allocation in a particular sector will reduce the effect on the NAV of the fund if the security gets default rated.

Why are the Effects Negative?

The effects of the newly introduced norms cannot be considered as negative. The upward movement in the AUM of overnight funds is only because of the investors who used liquid funds for frequent transactions. Those who used it for short term capital appreciation of more than a week are loving the latest norms as these have been implemented to reduce the risk levels in liquid funds. The investors, as well as experts, have appreciated the new norms as the investments in liquid funds are now more secure and promising. Overnight funds are made for the investors who want to buy and redeem more frequently such investors should not invest in liquid funds.

The latest norms of liquid funds have been introduced to reduce the risk involved in liquid mutual funds. The decision has been welcomed by the mass while those who are uncomfortable with the 7-day exit load can switch towards overnight funds. Increasing the involvement of overnight funds was one of the aims behind the newly introduced norms of SEBI. To know more on how you should use liquid funds in a better way, connect with the financial experts at MySIPonline.

Can I Invest in Mirae Asset Emerging Bluechip Fund to Buy a House in 10 Years?

Buying a house is never an easy task. With the housing prices increasing at a great pace, it will be a dream to buy houses of our own in the near future. Although, with the availability of modern investment tools, financial planning to buy a house can be done conveniently if the investment is done in a disciplined manner. Mirae Asset Emerging Bluechip Fund can be an ideal choice for such financial objectives as the fund aims to deliver long term capital appreciation to the investors. The experts at MySIPonline recommend investing through SIP in Mirae Asset Emerging Bluechip Fund to achieve the target in 10 years.

What is Mirae Asset Emerging Bluechip Fund?

It is a top performing mutual fund in India which has excelled in every aspect of comparison with the peers. It falls under the category of large and mid-cap mutual fund and holds the respect of being one of the best in the category. It has delivered consistent gains to the investors for a long time under changing market conditions. The fund manager Mr Neelesh Surana is highly experienced to grab every money-making opportunity in the large and mid-cap segment. Mirae Asset Emerging Bluechip Fund has delivered the highest returns to the investors in the category and is also one of the most rewarding mutual funds in India.

To Buy a House in 10 Years

Buying property after 10 years can be a challenging task. Considering the growth rate in the cost of construction, a well-furnished flat of 2 BHK or more can be worth more than 2 crores after 10 years. To achieve such a gigantic financial target, investors need to plan in advance. Using the SIP calculator at MySIPonline, we can calculate the amount that needs to be invested monthly in Mirae Asset Emerging Bluechip Fund. The fund has maintained more than 20% trailing returns since inception and the trailing returns for the last 5 years are also more than 20% hence for next 10 years, we can expect the fund to deliver returns of anywhere between 16 to 20%. To buy a decent house or flat at a good location one needs to invest Rs 50,000-70,000 every month for 10 years. Investments should be done in a disciplined manner regardless of the market conditions.

Can Anyone Invest?

Investors need to understand that Mirae Asset Emerging Bluechip Fund is an equity scheme and the investments are done in various equity instruments. The performance of the fund entirely depends upon the stocks selected by the fund manager. He invests an equal proportion of corpus in large and mid-cap stocks. The fund involves high risk due to major involvement of aggressive stocks. Investors must be ready to face frequent fluctuations in the short term as the market trends are highly responsible for the performance of the scheme. The stocks selected by the fund manager can be highly productive in the long term.

Mirae Asset Emerging Bluechip Fund is a top-performing mutual fund in India and can be chosen for long term capital gains. It can be a great choice if the investment tenure of more than 5 years. The fund has a superior track record and can be an optimum choice for buying a house after 10 years. To make a personalised investment plan for free of cost, connect with the financial experts at MySIPonline.

Why is ICICI Prudential Bluechip Fund Most Ideal for Conservative Equity Investors?

If you are among the mass that expects minimal risk from pure equity mutual fund, then ICICI Prudential Bluechip Fund is what you are looking for. This large-cap fund invests only in the best of equities in India and is considered as the safest equity schemes as almost every stock present in the portfolio possess a ‘bluechip’ quality which makes the portfolio more promising and less risky for the investors. The experts at MySIPonline recommend the scheme to a number of conservative equity investors seeking long term capital gains. Read till the end to find out the reasons which make it an optimum choice for low-risk equity investments.

ICICI Prudential Bluechip Fund; Know Before Investing

This bluechip fund follows the mandate of a large-cap fund and was launched in 2006 by ICICI Prudential Mutual Fund with an aim to deliver long term gains to the investors from the stocks of leaders of Indian economy. The fund has strategically utilised every positive opportunity in the equity market to deliver better gains than peers while the negative returns have always been limited above the benchmark and category average. Following are reasons which makes it an optimum choice for conservative equity investors.

- Least Risk in The Category

The risk stats of ICICI Prudential Bluechip Fund are among the best in the category. The risk is measured by standard deviation and beta for the past performance of the scheme and it has maintained least deviation from mean for a long time. Hence it is considered as the least risky scheme in the category. - Most Chosen Scheme in the Category

It has the highest assets under management in the large-cap category of equity mutual funds, despite coming later than most of the peers. ICICI Prudential Bluechip Fund was launched in 2006 but has been chosen by more number of investors due to impressive and satisfactory performance at a consistent rate. - Well Structured Portfolio

The portfolio of ICICI Prudential Bluechip Fund is well diversified and has stocks from various sectors to reduce the volatility. Most of the companies in the portfolio are leaders of their respective sectors and are well-established entities with a superior track record. They are financially stable and can resist smaller fluctuations in the market easily. - Experienced Managers

ICICI Prudential Bluechip Fund is managed by Mr Anish Tawakley and Mr Rajat Chandak who are highly experienced in asset management business and take concerned calls considering the mandate of the scheme. They have years of experience and hold prestigious degrees with them. - Defensive Investment Strategy

The fund managers do not involve mid-cap and small-cap stocks in the portfolio as they bring unwanted risk. The growth style of investment is strictly followed even if attractive valuations are available in the market. Maintaining low risk and consistency in returns is the top priority of the managers.

ICICI Prudential Bluechip Fund has provided best returns in the category in the long term while maintaining low risk in the short term. This unique ability of the scheme has been successful to attract millions of investors. It is an ideal choice for the investors with low-risk appetite seeking pure equity mutual fund for long term capital gains. To start investing today or to know more about the scheme, connect with the financial experts at MySIPonline.

Tata Digital India Fund; Should You Invest in the Best Sectoral Scheme of India?

In the last few years, the technology sector has witnessed tremendous market conditions as the concerned stocks have been constantly achieving new heights. Tata Digital India Fund is currently one of the best sectoral scheme in India as the technology sector has been contributing a lot to the Indian economy in the last few years. It was the most productive mutual fund for the calendar year of 2018 and the YTD returns for 2019 are also at impressive levels. Despite impressive stats, experts at MySIPonline recommend the scheme only to a limited audience. Is Tata Digital India Fund suitable for you?

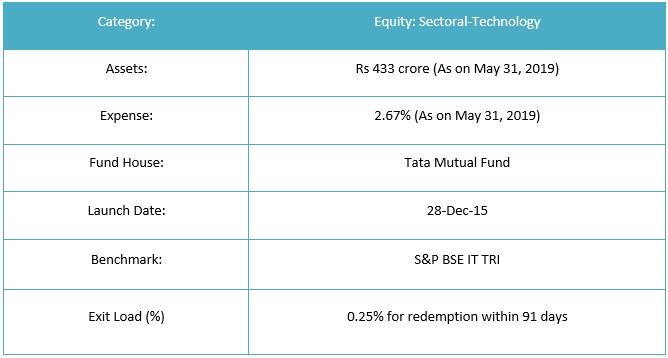

What is Tata Digital India Fund?

Tata Digital India Fund is without a doubt one of the best sectoral schemes in India that invests in the stocks of IT companies. The returns have been mostly ranked among the best in the category. Despite coming later in the market, it has earned the respect of being a top-notch performer. The fund managers Ms Meeta Shetty and Mr Sailesh Jain invest nearly 50% of the corpus is invested in TCS and Infosys. 10-12 stocks are included in the portfolio and growth style of investment is followed.

Why is IT Sector Successful in India?

The IT sector has witnessed a rapid growth in recent years which is expected to stretch for a long term in future. The key reason for the exponential growth of IT sector in India is the increasing number of engineers ready to work at lower wages. India is the largest exporter of IT products and the majority of the revenue in the sector comes in foreign currency. Hence, the weakness and strengthening of Rupee also play a vital role in the performance of IT stocks in India. TCS and Infosys are the leaders in the industry while a lot of emerging IT companies are growing rapidly.

Is it Suitable For You?

The performance stats of Tata Digital India Fund might look impressive and the sector also has a great scope in the future. However, all the stocks in the portfolio are from the IT sector and any slump in the sector might pull every stock prices resulting in steep fall in the NAV of Tata Digital India Fund. The fund has a focused portfolio and only has 10-12 stocks which are not enough to diversify the portfolio of the scheme. In simple words, the fund possesses a high risk and can deliver a sudden rise or fall in returns. To take the optimum advantage of the scheme, the investor needs to keep a close eye on the performance of the IT sector in the economy along with probable outcomes in the future. Hence, the fund is ideal for experienced investors who can make informed calls and can take high risk in mutual fund investments.

Tata Digital India Fund is one of the best mutual funds in India but certainly not suitable for every kind of investors. Investment in mutual funds must be done according to the investment objective and risk appetite of the investors. The fund must not be chosen for short term trading as it can show exponential fluctuations. Investors must take the assistance of financial experts at MySIPonline before investing who can also guide throughout the investment process.

How the Tax Calculator is Reshaping Tax Assessments in India?

When you think about tax, what’s the first image that pops in your mind? Do you picture something pleasant? Are you at peace when you think about your tax bills? Well, most of you would say a big NO to all these questions because the fact is that nobody likes to pay taxes. It is something that is forced on us to keep the country breathing. Yes, it is essential, but you don’t have to pay a huge sum every year. You can keep your taxes in budget and still contribute in rising the country.

Surprised?

The Tax Calculator is a way out to your rising tax bills. It is a devise that will help you to analyse how much tax you’re paying and how you can curb it. This tool is available on MySIPonline, which is one of India’s favourite online investment destinations.

Let’s see how you can control your tax liability with this simple tool.

The Taxation in India

In order to practice the art of tax-saving, it is important to understand the prevailing tax system in our country. Normally, a middle-aged person (under 60 years) is charged tax on progressive basis over and above ₹2,50,000, every year. The final liability is calculated on the total taxable income which is calculated after adding/deleting certain items from the computation. While of course you’ll get the deduction of your expenses, but they aren’t the only way to drop your taxable income.

Under the Income Tax Act, 1961, the law provides certain deductions, exemptions, and relaxations that you could use to bring down your tax bill. Section 80C is one of the many sections that provide such deductions. Under this section, you can avail a maximum deduction of ₹1, 50, 000 from your taxable income, which in turn can shrink the tax liability by ₹46, 800. And to achieve this deduction, you can invest in any of these options: -

• ELSS Funds

• Public Provident Fund

• National Pension Scheme

• Life Insurance

• Bank fixed deposits

However, out of all the above options ELSS schemes are considered to be the best, as they bear the least lock in period (3 years) and also provide highest amount of returns that can flare up to 20%.

The Role of the online Tax Calculator

The Tax Returns Calculator is not a tax-saving option, but merely a tool to configure your taxes. By using it, you can keep a track on your income, expenses, and deduction eligible investments. This in turn will help you to organise your transactions and help you to identify how much scope is left for saving taxes.

For instance, take a look at the following diagram which is a replica of the Tax Calculator’s interface:

As you can observe here, the Tax Planner seeks basic information and processes it to the final tax liability. The narration of the various items here hints you in plenty about the tax-saving options available. Hence, this tool will be a great aid in your tax planning. Moreover, you can run this computation numerous times at MySIPonline, without shelling even a dime out of your pocket.

There are several legitimate ways which you can adopt for saving taxes, and using the Tax Calculator facilitates identifying them. Start your tax planning today at MySIPonline, and save up to ₹46,800 every year on your tax bill.

Why are Equity Schemes of HDFC Mutual Fund Performing Better Than Peers?

HDFC Mutual Fund became the largest fund house in India in terms of AUM and number of investors. The AUM of the entire fund house is constantly snowballing at a great pace and the major reason supporting the growth are the equity schemes provided by HDFC MF. The equity schemes of HDFC Mutual Fund have performed exceptionally well in recent years even when the market conditions remained volatile for the equities. The credit goes to the diligent fund management staff led by Mr Prashant Jain who is at present, one of the best fund managers in India. The experts at MySIPonline have been recommending the equity schemes of HDFC MF to a large number of suitable investors due to multiple reasons.

1. Best Team of Fund Managers

HDFC Mutual Fund has the best team of fund managers. The equity investments for the AMC are led by Mr Prashant Jain who is also the fund manager of most of the top-rated equity schemes of HDFC Mutual Fund. The managers are highly experienced and are qualified from the best institutions in the world.

2. Stock Selection Strategy

Outperformance over the peers majorly depends on the stock selection strategy. All mutual funds grouped under a particular category can choose stocks from a particular set and the stocks selected by the managers at HDFC MF have delivered best returns over the years. The stocks of companies with sound management and high growth potential are selected for the portfolio of equity mutual funds.

3. Research-Based Investing

A multi-level research-based approach is followed for investment and stock selection. The compatibility and synchronization of the chosen stocks are also matched with market trends and expectations. The rigorous research filters out the best stocks for the portfolio of the equity schemes and they deliver better returns than the peers.

4. Investment According to Mandate

The investments in equity schemes of HDFC Mutual Fund is done according to the predefined mandate. The stocks which are not suitable for the objective are not involved in the portfolio even if they are available at attractive valuations.

5. Track Record

Majority of the equity schemes at HDFC Mutual Fund are most consistent ones and have an impressive track record of providing highest returns in the category which gives a boost to sentiments of the investors with the confidence of getting better returns from the schemes.

Equity schemes aim for long term capital gains and the management staff at HDFC Mutual Fund does not backs off from taking short term pain to provide better long term gains. The following equity schemes provided by HDFC MF are currently the best performing schemes in the market and have contributed the fund house to become the largest in India. The experts at MySIPonline have recommended these schemes to suitable investors on a large scale.

Top Performing Equity Schemes of HDFC Mutual Fund

HDFC Equity Fund

HDFC Top 100 Fund

HDFC Mid Cap Opportunities Fund

HDFC Small Cap Fund

HDFC Hybrid Equity Fund

Equity mutual funds provide long term gains at moderate to high risk depending on the type of stock selected for the portfolio. A large number of successful investors have trusted the equity schemes of HDFC Mutual Fund for long term gains. To know whether you should invest or not, connect with the experts at MySIPonline.

It’s Official! The List of Top Performing Funds in India is Out!

People in India have begun relying on mutual funds for achieving their objectives. Since the commencement of online SIP investments, there has been an influx of the investing mass that could never be thought of a few years ago. However, there is still reasonable confusion among the investors as to which fund they should choose for their financial plan. Which particular fund can bring desired results is an age-old question, and the answer keeps on changing since mutual funds operate in a dynamic environment.

To attain the best results, it is advised to invest the top performing mutual funds that have been rated very high in the market. They are handpicked by the experts after testing them on several parameters, and thus, can be added without any worries in the financial plan.

Let’s check out which funds made it to the top list in 2019.

The Top Funds to Invest in India in 2019

Since the market is a volatile place, the recommendations and suggestions may change over time. Hence, the options presented here are as per the current market situations, and have been selected after getting a free pass from the experts of MySIPonline: -

Axis Bluechip Fund (G)

The first fund to be named as the top mutual fund this year belongs to the large cap category, owning huge stakes in established Bluechip companies. It has spent more than 9 years in the market, and hence, can be cited as an experienced fund fit for long term investments. The past results are pleasing, where the average score till date stands at 12.26%. Also, the risk exposure is less which makes it an all-rounder fund that can be bought by any individual.

Reliance Large Cap Fund (G)

Yet another large cap fund, this is one of the most powerful investment options available today. With ₹13,170 crore worth of assets on its side, the fund has enormous potential to expand in the future that can help you gain enormous wealth in the long run. The returns are great, standing at an average of 15.78% since inception. Beating the benchmark and the peers, it stands at the fifth spot among the best large cap funds to invest in India.

Aditya Birla Frontline Equity Fund (G)

This fund has a history of performing neck to neck with its benchmark, and has indeed beaten it a couple of times in the past. On an average, the fund has scored 20.46% returns since its beginning in 2002, and now stays at the position of one of the best paying large cap funds in India. Also, the last five year performance where the yield was 10.62%, annually, placed it adjacent to the best performing large caps. So, if you wish high returns with good security, you can invest in this option.

ICICI Prudential Bluechip Fund (G)With assets worth ₹22,182 crore under its belt, this fund stays one of the wealthiest large cap options in India. It has recently made some changes in the portfolio to adjust with the market, and hence, has gained momentum in the wealth creation process. The past performance have beaten the benchmark and the category returns, standing at the level of 11.30%.

Making a financial plan that can grow your wealth and help you achieve your objectives is reasonably difficult. But, with the right funds you can accomplish the difficulty very easily. Invest in the top performing funds via MySIPonline and create a solid portfolio that can match your needs. For further assistance, call our support desk at 9660032889.

Why do Experts Recommend Mirae Asset Emerging Bluechip Fund?

Bluechip companies are nationally recognised, well-established companies that have a long history of successful performance in the market. They have a sound financial position and can afford huge expansion in the future, thus spreading success and prosperity among their stakeholders. They have the capacity to face downturn market situations and carry out full-fledged operations, thus maintaining high growth and earning high returns.

Bluechip companies are nationally recognised, well-established companies that have a long history of successful performance in the market. They have a sound financial position and can afford huge expansion in the future, thus spreading success and prosperity among their stakeholders. They have the capacity to face downturn market situations and carry out full-fledged operations, thus maintaining high growth and earning high returns.

Keeping these advantages in view, many market experts today advise to buy stakes in these companies. Mirae Asset Emerging Bluechip Fund is a good route to get associated with these companies. It will help you to buy stakes in established companies and enjoy a successful investment attuned to your needs.

The Basic Idea

As evident from its name, Mirae Asset Emerging Bluechip Fund (G) is a mutual fund that mainly invests in Bluechip companies. It belongs to the equity family, and dwells good strength and power to achieve high returns and sustain steady growth. It was started nearly a decade ago in 2010, and has since accumulated huge wealth that amounted to ₹7, 617 crore on 31st May 2019. The primary objective of the fund is to identify potential Indian Bluechip companies and invest in them through a diversified portfolio that consists of large and midcap stocks.

The Performance

Following the unique strategy of investing in both large and midcap stocks, Mirae Asset Emerging Bluechip Fund – Regular Plan (G) has achieved remarkable results. In the last five years, the fund earned returns worth 20.66% which were way higher than the benchmark returns that stood at 11.45% and the category returns that stood at 12.20%. Also, the annual average yield of the fund since inception sits at a very high value of 20.89%. Thus, an investment in this fund will gain you huge returns and enable you to win your desires.

The SIP Investment

The returns mentioned above will be easier to achieve if you plan an SIP investment in Mirae Asset Emerging Bluechip Fund (G) via MySIPonline. Under an SIP arrangement, you’ll be spending just ₹1000 a month instead of stashing your entire budget at once. This will also allow you to gain the benefit of compounding, besides providing the liquidity to invest in other profitable ventures.

Some Useful Investment Tips

Before you commence an investment in any mutual fund, it is important to get acquainted with some basic facts associated with the investments. If you are planning an investment in Mirae Asset Emerging Bluechip Fund, then the following tips will be really helpful: -

- Checking the NAV

You should always have a track of the fund’s NAV, at least for a few days before your decided date of investing. This will help you to analyse how frequently the assets are bought/disposed off by the fund house. The NAV of Mirae Asset Emerging Bluechip Fund (Growth) on 12th June 2019 was ₹54.416. This value arrived after the fund fell by 37 basis points on the graph.

Setting the Time Horizon

Mirae Asset Emerging Bluechip Fund will work best if you set the course for a long-term investment. This will fetch you better growth and higher returns, besides saving you an exit load charge on early (within 365 days) redemptions.

Using MySIPonline

MySIPonline is one of the best online investment portals in India. It provides easy online investment services and tons of tools to measure your investments at different stages, all for free.

Hence, planning an investment in Mirae Asset Emerging Bluechip Fund (G) via MySIPonline can set you miles ahead in your investment. So, start now and set your future spirits high.

How Kotak Standard Multicap Fund is Performing Better Than Expectations

Kotak Mutual Fund is one of the most popular names in the mutual fund industry and has provided several top-notch schemes in different categories. One such scheme that has gained huge popularity in the multi-cap space is Kotak Standard Multicap Fund. Over the years, this scheme has provided an exceptional growth to the investors and has gathered the trust of millions of investors. Since the past few years, this scheme has broken many negative convictions made against it and has provided growth with the same consistency it was providing before.

Let’s take a look at some major instances, where this multi cap scheme from Kotak has performed better than the convictions made against it.

Conviction 1: The Scheme Will Not Perform After Category Change

As you may know that in April 2018, during the re-categorization process ordered by SEBI, this scheme was changed from Kotak Select Focus Fund to Kotak Standard Multicap Fund. Many experts, as well as investors, were saying that the scheme will not perform well from now onwards, as the investment strategies and style have changed. But, this scheme proved those investors wrong by providing stable growth even during the unstable market behavior during 2018.

Conviction 2: Huge AUM Will Restrict the Growth

This is yet another major conviction made by the people when the AUM of the scheme crossed the Rs. 22,000 crore line. People said that due to the huge AUM it will be really hard for the manager to manage the scheme. But, here again, Kotak Standard Multicap Fund proved them wrong and provided one of the best returns in the multicap category.

Conviction 3: Will Not Be Able to Beat Volatility

During the year 2018, when the equity market was going through heavy volatility, and most of the schemes were showing negative returns, a lot of people were expecting the scheme to show huge negativity in the returns, but nothing like this happened. Kotak Standard Multicap Fund Growth Plan not only managed to cap the downfall during the market volatility, but was also very quick to recover from it, and provided 13.82% (As on Jun 04, 2019) returns in the past 1 year. Not only this, the current portfolio of the scheme has been constructed in such a way that in case of future volatility too, Kotak Standard Multicap Fund will be able to manage the volatility greatly.

As you can see that the scheme has been continuously breaking the false convictions made against it. This multi cap scheme from Kotak Mutual Fund has been consistently working towards providing optimal growth to the investors. Now, if you are planning on investing in this scheme, you can check the process by reading further.

How to Invest in Kotak Standard Multicap Fund Online?

The investments can be done in 4 simple steps and they are as follows:

- The very first step is to create an account on www.mysiponline.com, which will not take more than 2 minutes.

- The second step is to complete KYC verification and Bank Mandate registration, which can be easily done online.

- After the verification is complete, you will have to select Kotak Standard Multicap Fund, and have to select the monthly SIP amount, the SIP deduction date and the tenure for which you want to do the SIP for.

- After you complete the process, your SIP investment will start from the next SIP deduction date.

With Kotak Standard Multicap Fund growth plan being such a good scheme, and the investment process being so easy, it is the correct time to start your investments. Just make sure that you stick to your long term goals, and in case you have any query about the scheme, feel free to connect with the experts of MySIPonline.

Why TATA Mutual Fund will be a Great Choice for Your Portfolio?

India holds a very large market for investments. Every month, more than 100,000 folios are registered with a single AMC, and this rate has been multiplying vigorously ever since the SIP plan was launched. Today, making investment in mutual funds has become easier than ever, and you can buy the top schemes in less time than you actually spent finding them.

TATA Mutual Fund is one of the few AMCs in India that provide top class products with high success rate. It is one of the oldest and largest fund houses in India, sharing its relation with the renowned TATA Group of India. With excellent fund management services, top class products and a high potential for future expansion, it has become everybody’s favourite in the regime of investing.

An Overview

TATA Mutual Fund is one of the oldest brands of mutual funds in India. It has been operating for over two decades, and has released superb schemes during this period. Belonging to one of the most prestigious group of companies, the TATA Group, the fund house has kept up to the legendary dynasty. With a barrage of top-performing schemes and a colossal asset base worth ₹54,193 crore (as of 31st March 2019), it is named among the most powerful fund houses domestically as well as internationally.

The Reasons to Invest in TATA Mutual Fund

Investing in mutual funds is definitely a very profitable venture. However, not all options can provide you with the same rate of success. Hence, experts today recommend tying up with established brands such as TATA MF, as they have the capacity to endure market risks and convert your investments into a large pool of assets. Further, you get to enjoy a horde of other benefits when you invest in such big brand, some of which are written in brief here: -

• Safety

One of the main things to ensure while drawing an investment plan is to ensure its safety. And it can be achieved only when you are putting your wealth in established avenues such as TATA Mutual Fund. Having an enormous wealth to back its activities, this fund house sustains security of assets and thus, can be opted for a safe investment venture.

• Growth

The schemes launched by TATA Mutual Fund in India are one of the best options to attain growth and achieve your objectives. Funds such as TATA Equity P/E Fund and TATA India Pharma & Healthcare Fund are a few examples of the top-performing schemes offered by this fund house that can help you achieve great success at your investments.

• Excellent Wealth Management

Wealth management is crucial task. The entire success of the fund house depends upon the quality of servility and professionalism show by the fund managers. At TATA Mutual Fund, the wealth of the investors is managed by some of the brightest brains in the fund management field. These men are equipped with a vast experience and a strong conviction, which are essential for navigating the fund through its survival phase and push it towards success.

• Easy, Affordable Plans

Investing in the top mutual fund schemes today is not at all difficult. You can invest in the best schemes of TATA Mutual Fund online with MySIPonline, by sending just ₹500 a month. You can even increase or stop your SIP later, if the circumstances may require such action.

Investing in TATA Mutual Fund through MySIPonline will set your investing in a high speed mode. Call your financial advisor today and chalk out a plan that can serve you best.

3 Ways SIP in Mutual Funds are More Than Your Eyes Can See

In India, SIP investments are looked as a way through which one can save money, by making investments at regular intervals. A lot of investors have not been able to apprehend the true objective of the SIP in mutual funds, and have been seen comparing it to instruments such as FDs, RDs, etc, which is not at all right. This is the major reason that a lot of people have not yet started the investments in these instruments and are keeping them away from the opportunities associated. This write-up will shed light on the different factors that make the Systematic Investment Plan more than your eyes can see.

Unpredictable Growth Opportunities

SIP investments are often confused with an investment option that can provide a fixed growth over a period, which is not at all correct. The best part about SIP investments in mutual funds is that they invest in a number of opportunities which help them in experiencing a different growth than fixed income instruments. Now, there are various factors that can decide what type of growth the scheme will show and these include the investment style followed by the fund, the management team, the market conditions, and others. So, when you invest for the long term, especially in the equity mutual funds, you will see your returns booming due to various factors, which is not the case with conventional instruments.

A Huge Variety

One other common misconception among people about SIP and mutual funds is they think of these instruments as only one single instrument. This restricts them to enjoy the most precious feature of mutual funds, which is variety. The mutual fund industry consists of different categories which follow different investment approach and each category have multiple schemes which have their own investment strategies. The schemes from different categories show a different kind of behavior and thus are suitable for different kind of investors. So, no matter if you are a high risk investor who wants a high growth or a low risk investor with moderate growth expectations, the mutual fund industry will have something for you.

Ease of Investment & High Liquidity

The third factor that makes mutual fund investment better than most of the conventional methods is the ease of investment. Since the online SIP investments have started the mutual funds have become an even better and time efficient options. For instance, if you want to make an investment, then all you need to do is visit MySIPonline, sign up for a new account by entering few basic details and have to carry out a quick online verification, and you are ready to go. Not only this, while redemption too, you will not face any problem, and can easily redeem your investments after 1 year without any charges. And, even if you want to redeem the SIP investments before 1 year, you can do it by paying a small charge. This liquidity is not seen among the conventional investment methods.

These are the three ways in which SIP is more than you think of it. There are other benefits as well, such as transparency, professional management, etc, which are often overlooked by people. So, if you have been putting your investments on hold because of these reasons, it is high time that you start.